Business Insurance in and around Andrews

One of Andrews’s top choices for small business insurance.

Cover all the bases for your small business

State Farm Understands Small Businesses.

The unexpected happens. It's always better to be prepared for the unfortunate mishap, like an employee getting injured on your business's property.

One of Andrews’s top choices for small business insurance.

Cover all the bases for your small business

Surprisingly Great Insurance

With options like extra liability, worker's compensation for your employees, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Lynn Fisher is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does arise.

Don’t let concerns about your business stress you out! Call or email State Farm agent Lynn Fisher today, and discover how you can meet your needs with State Farm small business insurance.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

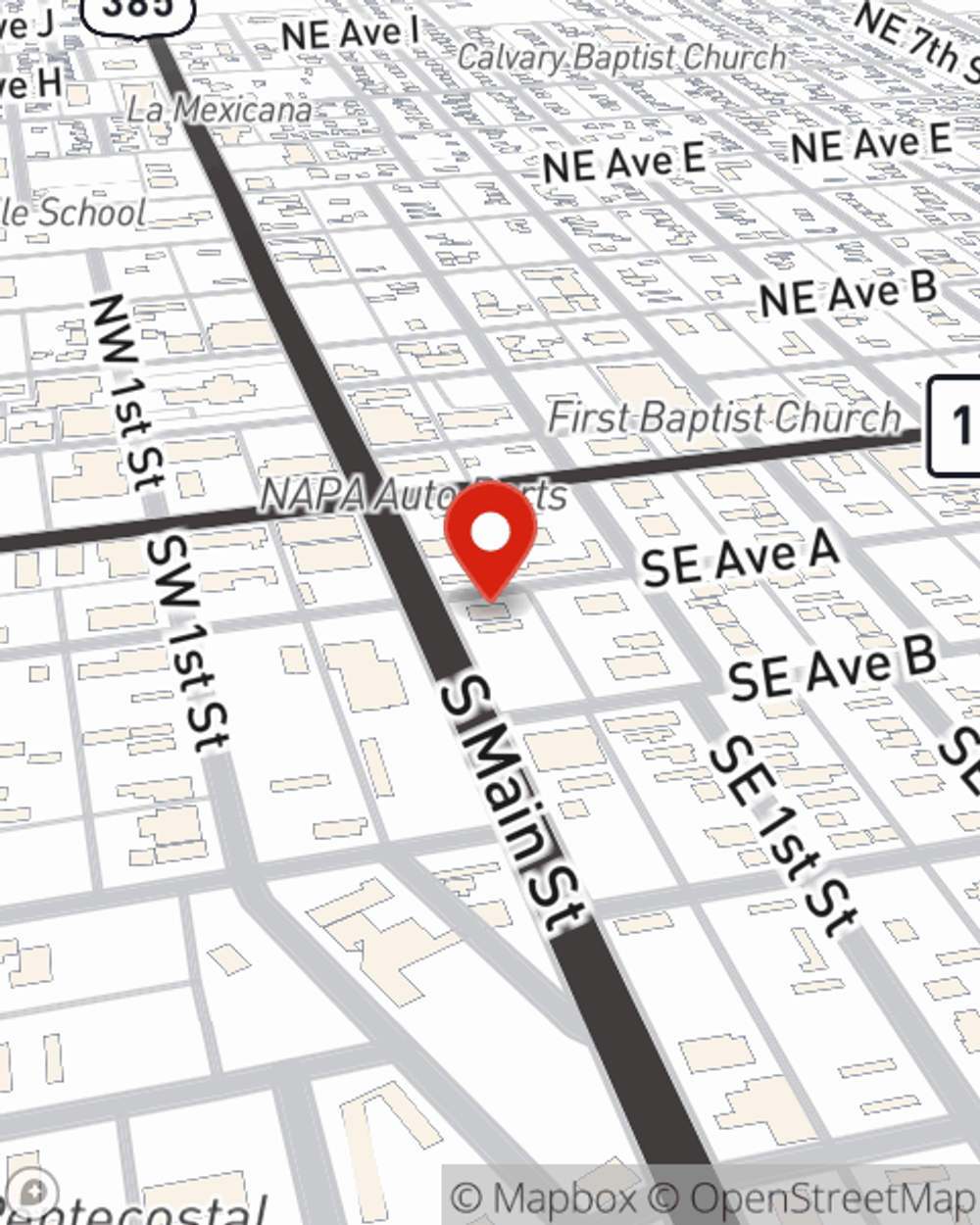

Lynn Fisher

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.